With the start of 2021 seeing the start of a new national lockdown, it sees the start of another uncertain year for self-employed workers in the UK.

“The self-employed are often more susceptible to an income shock than employed individuals, whether it’s because new contracts fail to materialise or unprecedented nationwide or global events hitting the economy,” noted research group The Exeter.

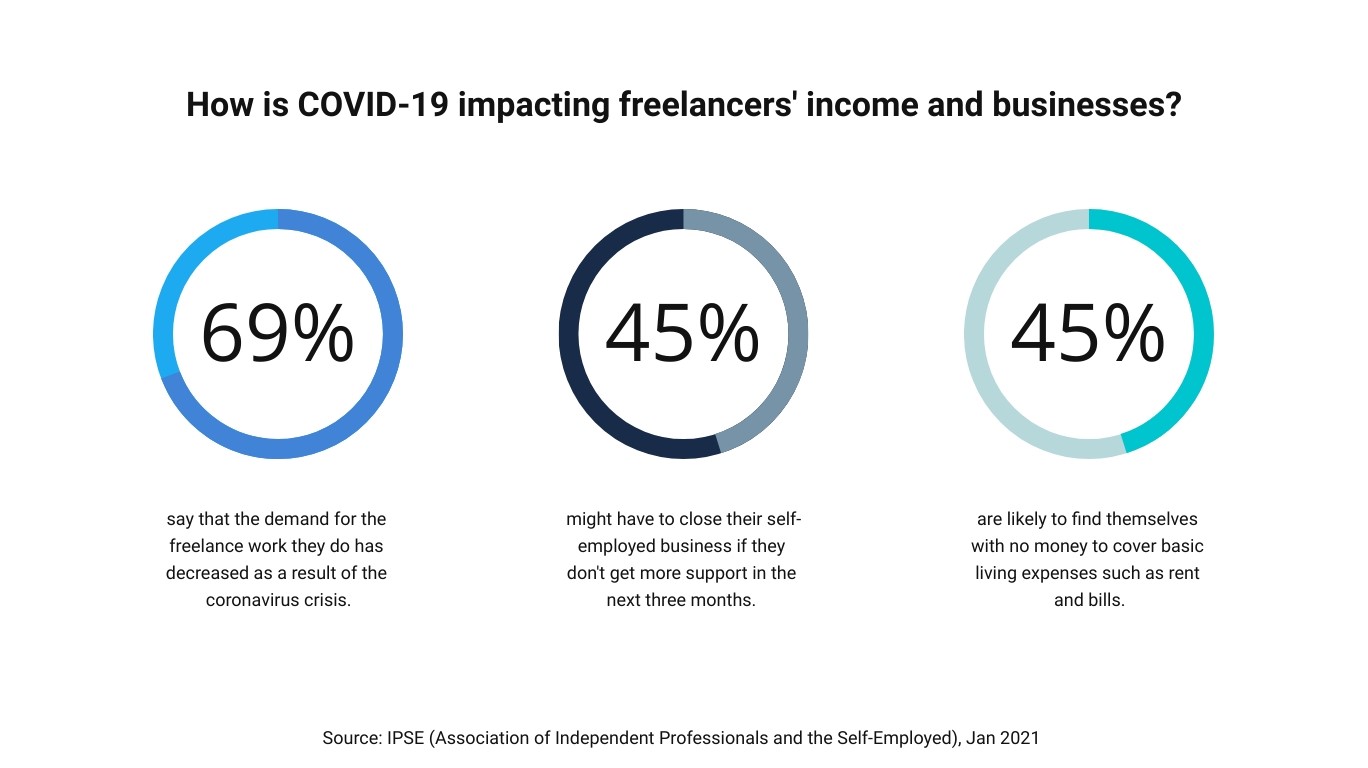

The vulnerability of the self-employed has been exacerbated by the COVID-19 pandemic: 91% of freelancers say they are concerned about the financial impact of coronavirus on them and their business.1

Despite the financial insecurity felt by the self-employed, only one in 10 earners have income protection, according to recent research by The Exeter.2

A lack of income protection – which pays out if you are unable to work due to injury or illness – can have short and long-term consequences on several aspects of financial wellbeing.

More than half of respondents told The Exeter they would rely on personal savings if they suffered an abrupt loss of income.3

But perhaps more worryingly, the research showed that many self-employed workers are saving less than £50 per month, leaving them at a risk if they have a mortgage to pay or a family to support.4

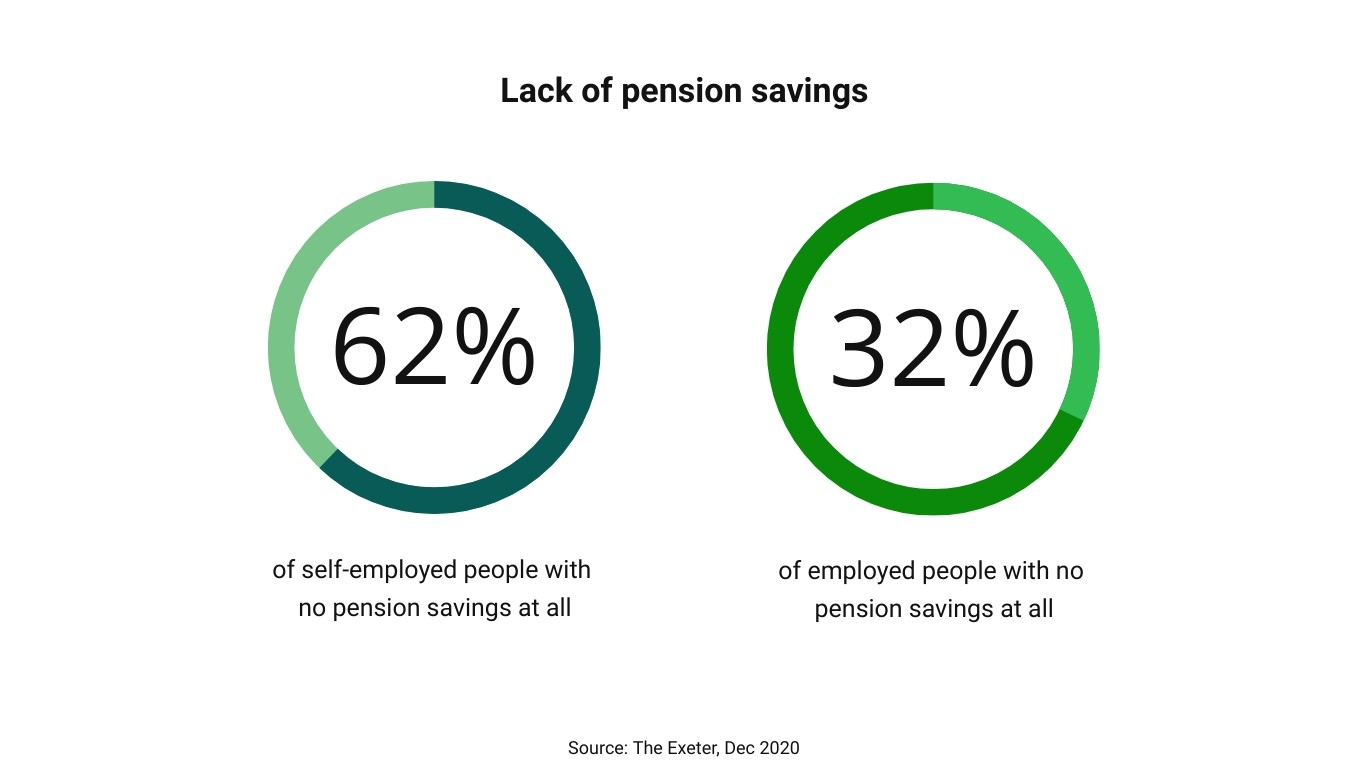

Over the longer-term, the freedoms that many self-employed people usually enjoy need to be balanced against the downsides of no sick pay provision or company benefits, such as employer pension contributions and redundancy payments.

Fluctuations in both the amount and regularity of income can affect how self-employed earners build a pension.

Over 50% of self-employed workers surveyed feared their retirement income would be insufficient for their needs, and more than a third were worried their earnings could be hit through illness.

Should the worst happen, income protection can help maintain regular pension contributions or mortgage repayments.

“This is an incredibly difficult period of time for the self-employed community, and the myriad of uncertainties faced by freelancers and limited companies underscores the importance of income protection,” said Paula Read, Head of Protection Proposition at St. James’s Place.

“Our financial wellbeing can be improved by having the right cover in place should the worst happen at the wrong time. It’s a no-brainer, particularly for the self-employed.”

This is an incredibly difficult time for the self-employed and proper planning is more important than ever before.

This article was provided to us by Geoff Day at Wilcox Day Wealth Management Ltd. Please note that this does not imply an endorsement by us.

You can review further articles that may be relevant, please visit www.wilcoxday.co.uk

Wilcox Day Wealth Management Ltd is an Appointed Representative of and represents only St. James’s Place Wealth Management plc (which is authorised and regulated by the Financial Conduct Authority) for the purpose of advising solely on the group’s wealth management products and services, more details of which are set out on the group’s website www.sjp.co.uk/products.

Geoff Day DipPFS, Cert CII (MP) 07940 717725 www.wilcoxday.co.uk

1IPSE/ Association of Independent Professionals and the Self-employed, Jan 2021

2‘Ill Prepared 2020’, survey of 3,000 self-employed individuals, The Exeter, Dec 2020

3‘Ill Prepared 2020’, survey of 3,000 self-employed individuals, The Exeter, Dec 2020

4‘Ill Prepared 2020’, survey of 3,000 self-employed individuals, The Exeter, Dec 2020

5‘Ill Prepared 2020’, survey of 3,000 self-employed individuals, The Exeter, Dec 2020